Conventional Loan Requirements vs. FHA Loan Requirements

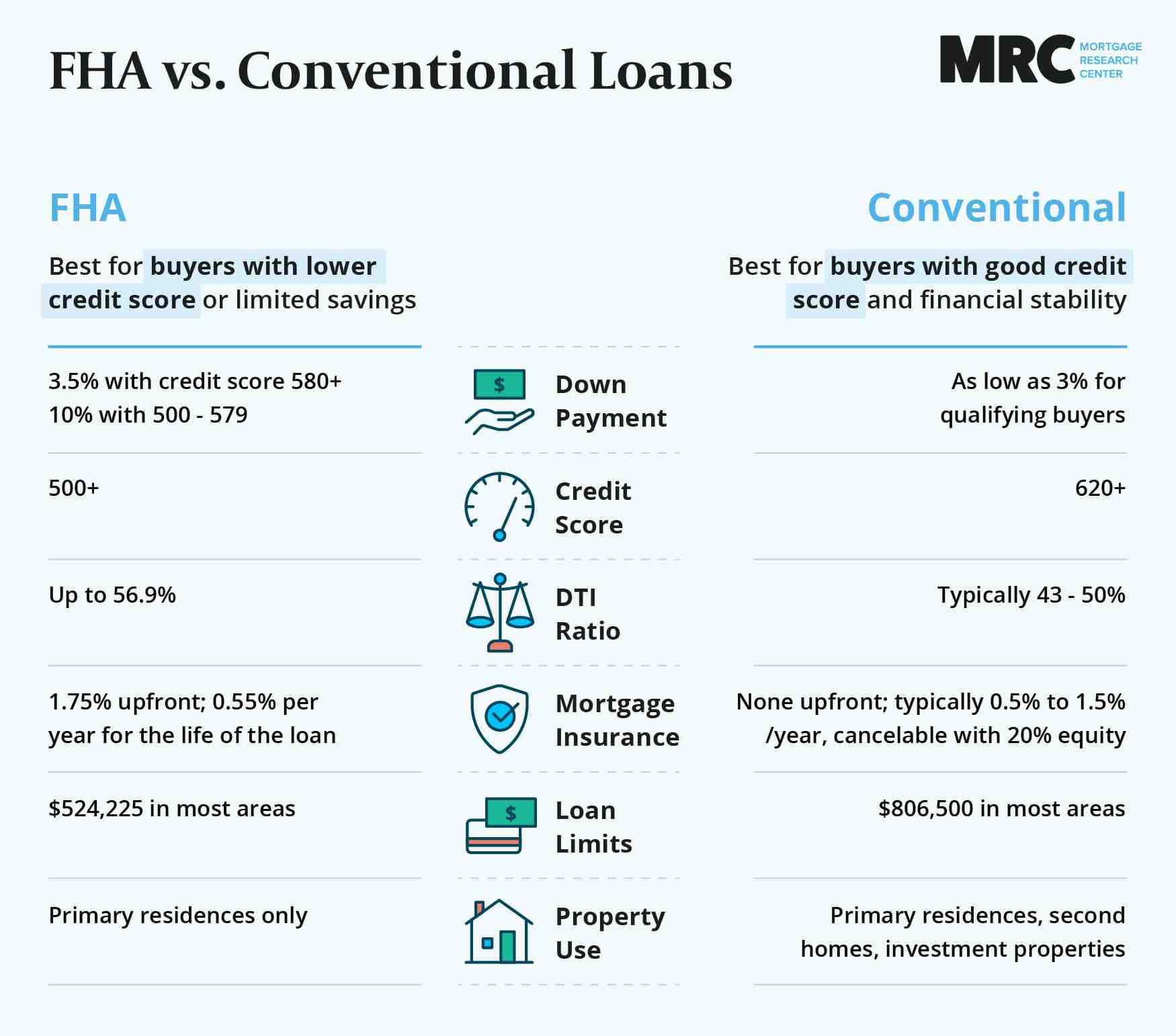

Conventional loans suit higher-credit borrowers with lower mortgage insurance costs, while FHA loans offer more flexible credit and debt requirements, making homeownership accessible to more buyers.

One of the first questions many homebuyers ask is whether they should get a conventional loan or an FHA loan. It’s a confusing topic: there’s no single right answer for everyone.

Here’s a look at the qualification requirements for each loan type to help you decide.

Summary Table: Conventional vs FHA Requirements | ||

Conventional | FHA | |

Credit Score | 620 | 580 |

Down Payment | 3% | 3.5% |

Debt-to-Income Ratio | 43-45% | 56% |

Employment | 2 years same line of work including college, with exceptions | 2 years same line of work including college, with exceptions |

Loan Limit | $806,500 | $524,225 |

Mortgage Insurance | Zero upfront; 0.5-1.5% of the loan per year | 1.75% upfront; 0.55% per year |

Property condition | Okay condition | Good condition |

Closing Costs | Generally 2-5% of the home price | Generally 2-5% of the home price |

First-time Buyer | Allowed, required for some programs | Allowed, not required |

There are quite a few caveats for the above summary, so let’s dive deeper.

Credit Score

Conventional: 620

FHA: 580

FHA is more forgiving about credit scores.

That’s obvious looking at credit score minimums, but there's more to it than that. Mortgage approvals aren’t based on your credit score alone.

For instance, you are not automatically approved for a conventional loan because you have a 620 score. A complex underwriting algorithm decides whether you meet criteria, and credit score is just one factor.

FHA’s algorithm will approve much weaker files than conventional. In fact, some borrowers could be approved with flying colors for an FHA loan, but be denied conventional, even with a 640 or 660 score.

Another way FHA is more lenient: it allows scores down to 500 if you put 10% down.

Down Payment

Conventional: 3%

FHA: 3.5%

Technically, conventional loans require just 3% down, slightly beating out FHA in this regard.

However, that 3% minimum comes with strings attached.

Some conventional 3%-down programs require you to be a first-time homebuyer. Additionally, you may have to meet income limits. For example, Fannie Mae HomeReady requires your income to equal 80% or less of your area’s median, as does Freddie Mac’s Home Possible mortgage.

You’ll also pay higher rates and mortgage insurance than FHA when you put 3% down on a conventional loan.

FHA is the most flexible program for those wanting a small down payment.

Both programs allow you to use eligible down payment assistance or gift funds to cover the entire cost.

Debt-to-Income Ratios

Conventional: 43-45%

FHA: 56%

Homebuyers with medium-to-high incomes should have no trouble meeting debt-to-income, or DTI, requirements for a conventional loan.

You can have monthly obligations up to 43%, or sometimes 45%, of your gross income and still qualify. That’s up to $4,500 in debt and housing payments versus a $10,000-per-month income.

However, those with lower incomes, high debt, or buying in a high-cost area might consider FHA. DTI can be 56% if the rest of the file is strong.

Here’s an example showing how FHA can get you approved for the same home even with lower income.

$10,000/mo Income | $8,000/mo Income | |

Loan Type | Conventional | FHA |

Home price | $400,000 | $400,000 |

Full payment* | $3,200 | $3,200 |

Student loans, car loans | $1,000 | $1,000 |

Total Payments | $4,200 | $4,200 |

DTI | 42% | 52.5% |

*Payments are examples only. Speak to a lender for your quote.

In the FHA example, the buyer may qualify for the same house as the conventional buyer, even though she has lower income. This is the power of FHA.

Employment

Conventional: Two years

FHA: Two years

Both conventional and FHA require two years of employment history, and both count time in college coursework toward work history.

However, FHA is more lenient about job gaps, periods of unemployment, seasonal layoffs, and job-switching. Check out our guide to getting a conventional loan if you have an employment gap for more information.

If you can explain job gaps and frequent changing of employers, you may be approved more easily for FHA versus a conventional loan.

Self-employed applicants will also find FHA more forgiving with more than one but less than two years in business.

Loan Limits

Conventional: $806,500

FHA: $524,225

Neither loan has a minimum loan amount, but both impose maximum loan limits. Conventional loan limits are higher in most areas of the country.

Conventional | FHA | |

1-unit | $806,500 | $524,225 |

2-unit | $1,032,650 | $671,200 |

3-unit | $1,248,150 | $811,275 |

4-unit | $1,551,250 | $1,008,300 |

Both FHA and conventional loan limits go up to $1,149,825 for a 1-unit home in high-cost areas and even higher for properties with 2-4 units.

Those looking in high-cost areas or needing a larger loan might choose a conventional loan due to its higher limits.

Mortgage Insurance

Conventional: 0.5-1.5% of the loan per year, cancelable at 80% loan-to-value

FHA: 1.75% upfront; typically 0.55% per year, non-cancelable

Mortgage insurance is likely the most complex item to consider for conventional and FHA loan requirements.

Conventional private mortgage insurance, or PMI is quite reasonable for those with a 720 credit score or higher. But PMI skyrockets for those with lower credit.

Many lower-credit applicants choose FHA for this reason alone. Someone with good credit will pay about the same over five years for conventional or FHA mortgage insurance. But someone with a 660 score will pay much higher costs for conventional PMI.

Monthly Mortgage Insurance Comparison: Conventional vs FHA, $350,000 home | |||

Conventional (720 Credit Score) | Conventional (660 Credit Score) | FHA (All Credit Scores) | |

Final Loan After Upfront Mortgage Insurance (if applicable) | $339,500 | $339,500 | $343,661 |

Monthly Mortgage Insurance Rate | 0.87%/yr* | 1.54%/yr* | 0.55%/yr |

Monthly Mortgage Insurance | $246 | $435 | $157 |

Total Mortgage Insurance Cost over 5 Years Including Upfront Mortgage Insurance (if applicable) | $14,760 | $26,100 | $15,331 |

*Conventional PMI rate from MGIC, 3% down

FHA requires an upfront mortgage insurance premium of 1.75% of the loan amount. This does not have to be paid in cash at closing. Instead, most buyers wrap it into their FHA loan.

Even with this cost, FHA mortgage insurance is probably cheaper for anyone with a credit score below 720.

Conventional loans do not require an upfront mortgage insurance payment.

Another thing to consider: mortgage insurance cancelation. You can cancel conventional mortgage insurance when you reach 20% equity in the home. FHA mortgage insurance is permanent.

Lastly, if you plan to sell or refinance in a few years, conventional could be the better option. The upfront FHA mortgage insurance is non-refundable unless you refinance into another FHA loan.

Property Condition

Conventional: Okay condition

FHA: Good condition

Some homes will not qualify for FHA financing because these loans come with stricter property requirements.

In short, the Department of Housing and Urban Development (HUD), FHA’s overseer, requires properties to be safe and livable, and the property to be good security for the loan. As such, the appraiser will call out safety and structural issues on the appraisal. The lender will require repairs before closing.

Common issues include:

Chipping paint (lead hazard)

Missing stairs and handrails

Frayed wiring, other fire hazards

Faulty decks and roofs

Potential asbestos hazards

Evidence of rodent and insect infestation

Lack of year-round access

Inadequate heating

No consistent source of potable water

Cosmetic issues are not a concern for FHA assuming they pose no safety or livability issues.

While FHA is more strict, conventional loans maintain standards as well. Some homes may not be financeable by either loan type. However, conventional appraisers do not have to call out FHA-required deficiencies, so some properties will pass the conventional loan appraisal process just fine.

If you’re unsure whether a property will meet FHA standards, ask your real estate agent to inquire about the home’s issues.

Closing Costs

Conventional: 2-5% of the home price

FHA: 2-5% of the home price

There is no meaningful difference between conventional and FHA closing costs besides FHA’s upfront mortgage insurance requirement mentioned above.

Closing costs for both loan types include paying for third-party fees that are required to process the loan, such as the following:

Appraisal

Title

Escrow services

Credit report

Flood zone search

County recording

Lenders also require you to prepay certain property costs at closing.

3-9 months of property taxes

14 months of homeowners insurance

1 year of flood insurance, if required

In all, these costs can add up. Six months of property taxes at $350 per month would be $2,100 for that single item, due at closing. Closing costs could add up to $7,000 or more on a $300,000 property.

Both conventional and FHA allow you to cover closing costs using gift funds or down payment assistance programs.

First-Time Home Buyer

Conventional: Required for some programs

FHA: Not required

While 67% of FHA loans go to first-time homebuyers, it’s not a requirement. Some people use FHA many times as they move or otherwise need another home.

Most 3%-down conventional loans require you to be a first-time homebuyer:

Freddie Mac Home Possible®: First-time buyers only

Freddie Mac HomeOne®: First-time buyers only

Fannie Mae 97: First-time buyers only

Fannie Mae HomeReady: Repeat and first-time buyers

A first-time buyer is defined as someone who has not owned a home or had ownership in a home for the past three years.

Conventional Loan Requirements vs FHA: Wrapping Up

Requirements for both loans are pretty generous and could make you a homeowner sooner than you thought possible.

Some applicants will qualify for both loans. In this case, examine the upfront and monthly cost of each to make a decision.

Many will qualify only for FHA, which isn't a bad thing.

Apply with a lender to find out which loan type can make you a homeowner.