USDA Student Loan Guidelines for Residential Mortgages

Having student loans won’t prevent you from qualifying for a USDA mortgage, but they will count toward your debt-to-income ratio, which can affect how large of a loan you are eligible for.

Having student loans won’t prevent you from qualifying for a USDA mortgage, but they will count toward your debt-to-income ratio, which can affect how large of a loan you are eligible for.

If you’re looking for an affordable option beyond a traditional site-built home, an FHA loan on a manufactured home could be the key to achieving your homeownership dreams.

Homeowners may need to wait up to 12 months before refinancing a government-backed mortgage or cash-out refinance. Some refinances are available right away for homeowners who can benefit from its terms.

The average age of first-time buyers is now a record-high 38. How to buck the trend.

USDA direct loans are more challenging to qualify for but offer lower monthly costs. USDA guaranteed loans are more widely available but have slightly higher, although still competitive, interest rates and payments.

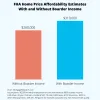

FHA recently announced a change to its boarder rental income guidelines, and it could mean expanded affordability for struggling first-time buyers.

The USDA funding fee comes in two forms: an upfront funding fee of 1% of the total amount borrowed and an annual funding fee of 0.35% of your remaining loan balance.

Technically, FHA Jumbo Loans don’t exist, but some buyers can still finance high-value homes with FHA loans. For buyers living in cities where home prices have skyrocketed, FHA high-balance loans can serve the purpose of an FHA Jumbo loan.

A new-construction home can save you the hassle of remodeling and could be more cost-effective than an existing home in the long run. But these are far from a fool-proof homebuying strategy.

USDA loans offer the opportunity to buy a manufactured home with zero down. But it must be a new, never-lived-in manufactured home to be eligible.