A mortgage rate float down gives you the best of both worlds: you can lock in your rate with a chance to lower it if rates fall.

In today’s volatile rate environment, it sounds like a no-brainer. Is there a catch?

How a Float Down Works

Here’s an example of how a float down might work. All rates are for example purposes.

You apply for a mortgage

You lock your rate at 7% with a float-down option

Two weeks before closing, rates drop to 6.5%

You exercise your float down by paying a fee.

You close the loan at 6.5% instead of 7%.

Now assume that, instead of dropping, rates rose to 8%. You keep your 7% rate.

Mortgage locks with a float down can protect you against rising rates while letting you benefit from falling rates.

Should You Exercise a Float Down Option?

If you’re already locked and rates have dropped, you’re debating whether to exercise your float down.

First, rates must drop enough for the lender to reduce your rate. Your loan officer may not automatically let you know when rates have reached that threshold.

As you approach closing, it’s worth reaching out to see if you can benefit from a float down.

Go ahead and take a free float down if you’re eligible. If there’s a fee, you have more work to do.

See how long it would take you to make back the fee. If longer than about two or three years, you should keep your locked rate.

Examining a Float Down Option

0.5% Float Down | 0.25% Float Down | |

Loan Amount | $300,000 | $300,000 |

Current Rate | 7% | 7% |

Float Down Rate | 6.5% | 6.75% |

Monthly Savings | $100 | $50 |

Float Down Fee | $1,500 (0.50%) | $1,500 (0.50%) |

Time to Recoup Costs | 15 months | 30 months |

Worth It? | Probably | Probably Not |

With the 0.25% rate reduction above, it would take over two years to recoup the costs. If you think you’ll have your home and mortgage much longer, it could be worth it. But there’s a reasonable chance you’ll refinance within a few years, negating your savings.

Should You Look For a Lender That Offers a Float-Down Option?

Most consumers don’t ask about float downs, but perhaps should consider it when shopping for lender.

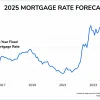

In the past, float downs were not common, since mortgage rates were falling from 2018 to 2022. Now rates are showing some of the biggest swings in years.

Plus, lenders don’t advertise float downs heavily. It costs them money if they grant one.

A lender that offers a float down may not be the best deal. They probably charge a fee to exercise it or build the cost into the initial lock. So a “free float down” may cost you more if you don’t use it.

Still, if rates drop significantly, at least you have the option to drop your rate.

Lenders like CMG Financial, UWM, and Guild Mortgage offer long-term locks while shopping for a home. If rates drop enough, these lenders may let you float down to a new rate.

When's the Latest You Can Float Down?

Each lender will set a deadline for when you can float down. Expect that to be two weeks or more from your closing date.

Even though the rate is dropping, your file will probably have to go through underwriting again, especially if a fee is required.

The lender can't drop your rate too close to the end, or it may not be able to complete it in time.

Can You Build Your Own Float Down?

In theory, you could build your own float down by applying with two lenders. You lock in one application and let the other one float. Close the one with the lower rate.

This sounds simple, but it’s difficult to execute.

You may incur extra fees. For example, you would have to order your appraisal with both companies for any hope of closing on time.

Plus, your seller, escrow company, title company, and many other parties need to know who your final lender will be long before closing.

You risk missing your closing date and losing your earnest money by switching lenders at the last minute. This is why it’s a better idea to find a lender with a float down option than trying the DIY float strategy.

How Much Do Float Downs Cost?

Some lenders allow a free float down. Others charge 0.50% to 1.0% of the loan amount.

Make sure you can recoup costs quickly if you exercise the option.

My Lender Advertises a Free Float Down. Is That Real?

Float downs potentially cost the lender, so they likely build extra fees into “free” float downs.

Still, you might find an exceptionally priced lender that offers a competitive rate and a free float down. There is little downside to this option. However, the same lender may be able to give you a lower rate without a float down option, so examine both offers.

Refinance vs Float Down

Can you refinance after closing if you don't get a float down?

You can, but at significantly more cost.

To refinance, you have to pay nearly all the same closing costs as during the purchase again. This could total 2-3% of the loan amount versus 0.5-1% for a float down.

If you have the opportunity to float down, do it instead of refinancing.

Float Down: Powerful Option In a Volatile Market

Rates show no sign of calming down. They have always been unpredictable, but volatility has reached a whole new level.

If you’re worried about rising rates, it could be a good idea to lock in early with the option to float down later.