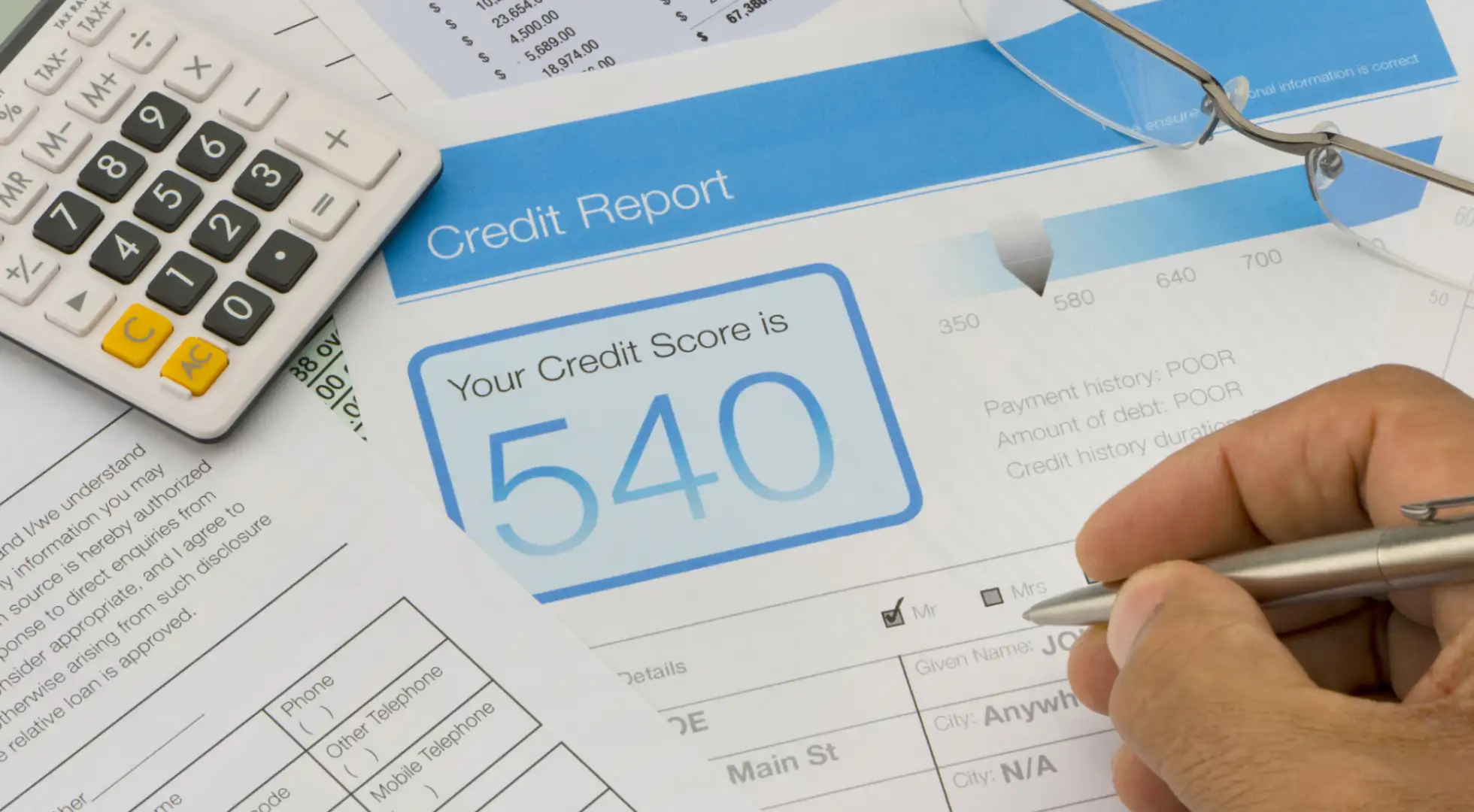

About 3.8% of mortgage dollar volume went to borrowers with credit scores below 620 in the third quarter of 2023, says the Federal Reserve Bank of New York.

While this isn’t a large number, it reveals that it is possible to buy or refinance a home without meeting the minimum for conventional loans, 620.

Thanks to FHA, VA, and USDA loans, many lower-credit homebuyers are being approved.

Following is more about the major programs that accept sub-620 scores.

Minimum Credit Score Requirements

As mentioned, you need a 620 score to qualify for conventional loans offered by Fannie Mae and Freddie Mac.

Luckily, those aren’t the only options. Following are minimum credit score requirements for other loan types. Keep in mind that lenders can set minimum scores that are higher than by-the-book standards.

FHA Loans

580 with 3.5% down

500 with 10% down

You might be approved for FHA with a very low credit score if you have 10% to put down on a house.

Not all lenders offer this option, though. Some will set a minimum score of 550 or 580. Speak to a few different lenders if the first one you talk to can’t accept your score.

USDA Loans

While USDA declares a 640 minimum credit score for a fully computerized approval, some lenders go well below that number.

Lenders will review applications between 580 and 600 via a manual review. Expect to have strong compensating factors to be approved.

VA Loans

According to the VA lending handbook, “VA does not have a minimum credit score requirement.” That means the VA puts the responsibility on lenders to determine a reasonable minimum score.

Because of this, you will see a wide variety of score requirements among lenders. Some might accept 500 credit scores while others won’t review anything under 640.

Shop around if you are turned away due to credit score alone.

Will I Be Approved If I Meet the Minimum Score?

Keep in mind that approval is not guaranteed if you meet the minimum score. This is a starting point only. Meeting the minimum earns you a deeper review.

For example, you might have a 590 score and apply for FHA's 580 minimum. But you have recent late payments and collections. The lender issues a denial.

Now imagine you have the same 590 score due to derogatory credit, but have a perfect 12-month payment history on all debt payments. You have much better chances.

Credit score isn’t the whole story.

General Guidelines to Raise Chances of Approval

Certain loan attributes will help you get approved for any type of mortgage if you have lower credit.

In some cases, the computerized algorithm will automatically consider “compensating factors.” In other cases, you may have to request a manual underwrite – a human review of the loan file.

Either way, it’s good to improve these factors if you have a weaker credit profile.

Zero Payment Shock: It’s a great sign if your all-inclusive housing payment is less than or equal to what you’re paying in rent. Your full housing payment includes the principal and interest payment plus taxes, homeowner’s insurance, and HOA dues, if any.

Down Payment: Putting down just 1-2% more than the required down payment can push you into “approved” territory. For example, FHA requires 3.5% down, but making a 5% or even 10% down payment lowers the lending risk significantly, improving your chances.

Low Debt-To-Income (DTI) Ratio: Those who purchase a home below their means have a better chance of being approved despite low credit. Your debt-to-income ratio is the percentage of your gross income you will pay toward housing and other debts. Keep your DTI under 35-40% for the best chances of approval.

Cash Reserves: It looks very good if you will have two to three months of your total housing payment in the bank after closing. You can continue making your payment if you lose your job or have unexpected costs.

Additional Income Not Counting as Qualifying Income: Certain income can’t be counted as income for the mortgage. For example, you have been making overtime pay for nine months. But you need at least 12 months to officially use it for the mortgage. The underwriter can consider it a compensating factor.

Strong Employment History: Those with long employment histories are highly marketable. They are less likely to lose their job and can find work if laid off.

Minimal Debt: Lenders like seeing borrowers who live below their means. They have wiggle room in their budgets. Having very little or no debt outside the mortgage helps the underwriter make a case that you'll repay the loan.

It's Always Worth Applying

Even if you think you can’t be approved, it’s worth applying. Many people assume they can’t be homeowners due to credit issues, but meet criteria nonetheless.

As mentioned, nearly 4% of total mortgage dollars were lent to sub-620 borrowers in late 2023. Even if you’re not approved now, the lender can let you know the steps to get there.