Normally, investors tend to treat U.S. Treasury auctions like background noise. They’re aware of these auctions of government securities, but they don’t really focus on them.

These auctions have been capturing more attention, and even worrying some market analysts, over the past few months. Yes, we’re still in the 2020s, where economic norms can be turned upside down at any time.

How Treasury Auctions Usually Work

Treasury auctions take place almost every day. They’ve been a regular part of the government’s fiscal life since at least the 1970s.

In Treasury auctions, the federal government sells bills and bonds to investors. Selling bonds and bills is one way the federal government finances itself. Ultimately, by selling bonds and bills, the government is borrowing money from investors.

Like any other type of borrowing, there’s an interest rate involved. With Treasury auctions, the government pays interest in the form of Treasury yields on the bonds and bills.

What Happens at Treasury Auctions

So here’s what can happen at a Treasury auction: The federal government announces what it plans to sell at auction — 10-year Treasury notes (T-notes), for example.

What happens next depends on what we all learned in Economics 101: Supply and demand.

When demand at an auction meets supply: Prices for the securities don’t fluctuate, and Treasury yields remain unchanged

When supply exceeds demand: This means securities aren’t selling at the price anticipated by the government. As a result, the Treasury decreases prices which increases yields (interest rates). This increase in yield entices more buyers to participate

When demand exceeds supply: Prices move up, and Treasury yields decrease, making these investments less attractive

Typically, these auctions go unnoticed by investors unless they’re buying securities themselves.

What Has Changed with Treasury Auctions Recently?

Treasury auctions have garnered more attention recently for one obvious reason: Yields have been higher.

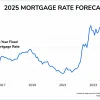

As everyone remembers, the Fed dropped interest rates in the wake of the Covid-19 pandemic, causing mortgage rates to reach historic lows in 2021. The Fed started raising rates again in 2022 and 2023. By the end of 2023, rates had climbed to their highest point in more than 20 years.

Higher rates should create higher yields for investors at Treasury auctions, so higher yields should attract more buyers. Specifically, the highest yields in two decades should be an enticing offer for investors.

And for a while they were.

Which brings us to the real reason these auctions have been in the news: Despite the higher yields, which have continued into the spring and summer, demand for Treasury securities hasn’t been all that high.

The government has had to increase yield on some securities. This has worried some market analysts.

What Imbalance at a Treasury Auction Really Means

This drop in typical demand for Treasury securities hasn’t shaken up the economy. After all, the Treasury is still selling securities, generating the money it needs to keep the government running.

But falling demand shows investors aren’t all that interested in locking up money in the federal government. Falling demand for government securities shows investors think they can do better buying private securities.

And this also has global economic implications. Foreign governments like China and Japan are big consumers of U.S. government debt. When they buy less debt, global market analysts notice.

What Lower Demand for Government Debt Means for Mortgages

In a nutshell, falling investor demand for government debt increases the interest rate the government pays on the debt. So how does this affect mortgage rates?

Historically, the yield on the 10-year Treasury bond influences mortgage rates. While mortgage rates aren’t officially connected to the 10-year T-bond, this bond is a traditional competitor for investors who buy mortgage debt from lenders.

Lenders have to keep their new mortgages competitive. If the 10-year bond interest rates increase, mortgage bond yields (interest rates) may also need to increase to stay competitive.

In a nutshell, lower demand and higher rates for government debt could push mortgage rates higher.

What Does This Mean for Today’s Homebuyers?

Larger market forces like Treasury yields affect average mortgage rates. But whether an individual buyer pays more or less than the average depends on other factors.

These factors include the borrower’s credit score, debt-to-income ratio, down payment amount, mortgage term, mortgage type, and lender.

In times of higher average rates, buyers can save more by keeping their credit score high, debts low, and shopping for the best rate with at least three different lenders.