FHA Rental Income Guidelines 2025 | Use Future Rent To Qualify

FHA loans make it possible to use rental income from a multifamily home to help you qualify — even if you're a first-time landlord. With the right property and a lender who knows the guidelines, rental income can be a powerful tool to boost your buying power.

Buying a duplex, triplex, or fourplex, and now a single-family home with an ADU is one of the most strategic moves you can make in real estate.

You become a homeowner and a landlord with one transaction.

But not every buyer knows about an FHA rule that could make it even easier to buy a multifamily property than a single-family home.

FHA rental income guidelines in 2025 enable borrowers to use future rents on the property to qualify for an FHA loan.

In this article:

How To Qualify More Easily Using Future Rents

First things first: the property must be a 2-, 3-, or 4-unit multifamily property. FHA does not allow you to use rental income on a single-family home unless there's an accessory dwelling unit (ADU) on the property.

You must also live in one of the units as your primary residence.

The lender will use a rent calculation and add it to your employment income. You can then use a combination of employment plus rent to qualify.

Here’s how it works.

FHA 1-unit | FHA 2-unit | |

Home price | $250,000 | $300,000 |

Monthly payment* | $2,200 | $2,500 |

Other debt payments | $500 | $500 |

Employment income | $5,200 | $5,200 |

Net rental income | N/A | $1,200 |

Qualifying income | $4,800 | $6,400 |

DTI | 52% | 47% |

Result | May not qualify | May qualify |

*Assumes FHA loan at 7.5%, 3.5% down, FHA upfront and annual MIP, property taxes, homeowners insurance, HOA dues.

In other words, you may be approved to buy a 2-4 unit property more easily than a single-family home.

How Do You Prove Future Income?

Proving future income on an FHA multifamily home isn’t as hard as it sounds. Here’s what you need.

If units are currently rented: Supply the lender with current lease agreements for the units you won’t be occupying. Ask your real estate agent to get this from the seller’s agent.

If units are not rented: The FHA appraiser will complete several reports, including an income/expense analysis (Fannie Mae 216/Freddie Mac 998) and a market rent analysis (Fannie Mae 1025/Freddie Mac 72).

From there, the lender uses the lesser of:

The projected income based on an income/expense estimate

75% of fair market rents or actual rents, whichever is lower

For example:

Report | Rent amount | Net rent |

Income/expense analysis | $800/mo | $800/mo (no deduction required) |

Market rent analysis | $1,100/mo | $825 (75%) |

Current lease | $900/mo | $675 (75%) |

Rental income used | $675 |

In the above example, the income/expense method does not need to be reduced because it already factors in a vacancy rate.

The other two methods require a 25% reduction because FHA assumes the property will be vacant 25% of the time, even though that’s very conservative. True vacancy rates in good markets are more like 5-10%.

Maximizing Future Qualifying Rental Income

Take a look at the example above. You’ll note that you have to use 75% of current rents to qualify, even though the unit might rent for more.

This is likely because the Department of Housing and Urban Development (HUD), the overseer of FHA, assumes you will not or can not charge higher rent or evict current tenants to raise rent.

So one strategy is to find a multifamily property without current tenants. These properties can be hard to find, though, so you may need to purchase a property with current leases in place.

Some properties have long-term tenants paying well below market rent. This is a sign of mismanagement; the landlord didn’t keep up with market rents.

The tenants will never leave. One strategy (though it might sound heartless) is to declare that you will live in the unit with the lowest current rent. The tenant will have to move on. Then you can qualify (and make more money) from the higher-priced units.

This should be a business decision and you shouldn’t feel bad for displacing a low-paying tenant.

More About the Appraiser’s Reports

The appraisal rent analysis can seem daunting.

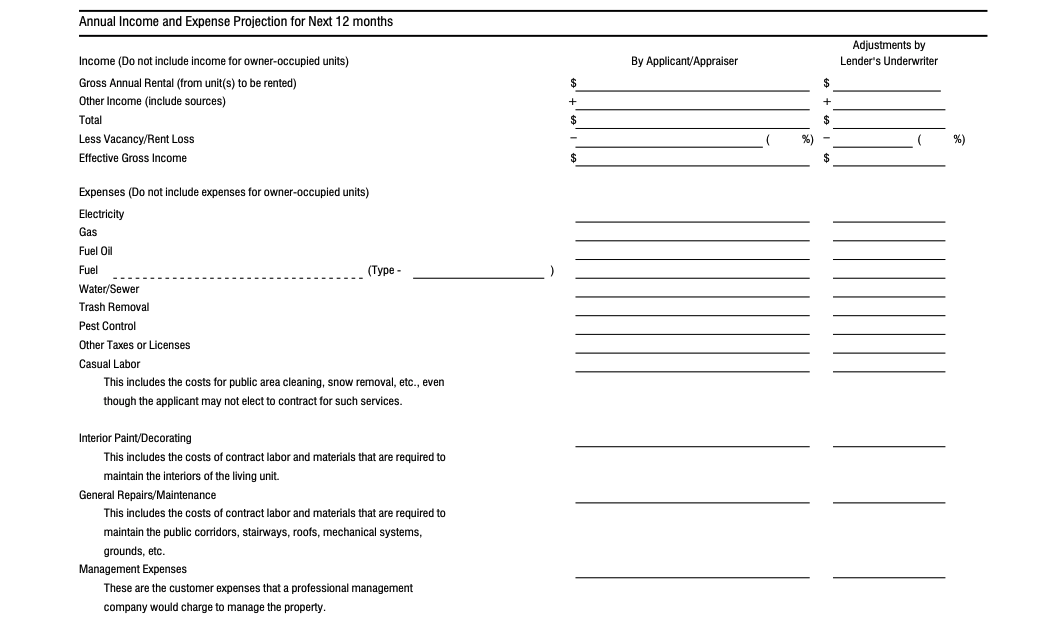

Operating Income Statement (Fannie Mae Form 216/Freddie Mac Form 998): If you’ve ever seen a “P&L,” or profit and loss statement from a business, this form is somewhat similar It attempts to calculate income and expenses from each unit to arrive at a net cash flow. Here’s a small snapshot of this otherwise lengthy form. To see the full form, download it here.

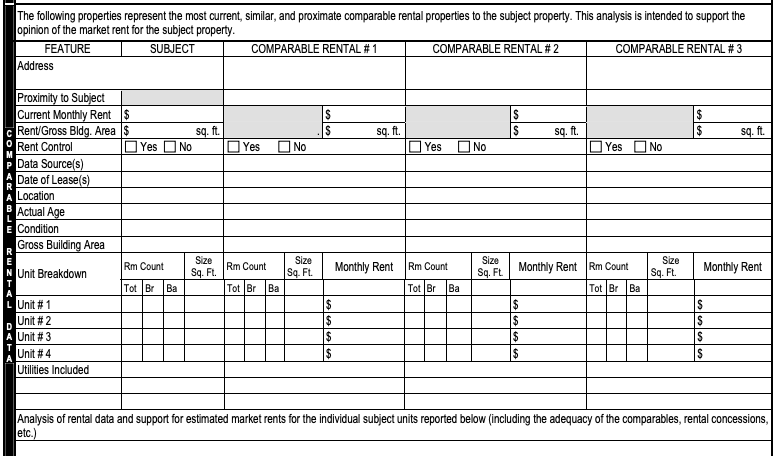

Small Residential Income Property Appraisal Report (Fannie Mae Form 1025/Freddie Mac Form 72): This is similar to the single-family appraisal report, except it is specific to 2-4 unit properties. It reviews comparable rentals in the area as well as comparable sales. Its purpose is to determine market rents for each unit as well as the value of the entire property. Below is an image of a part of the form, or you can download it here for a full view.

Rental Income From Another Property

FHA rental income guidelines can get very muddy concerning rental income from another property:

The property you’re buying (the “subject property”)

A different property you own for which you collect rent

To keep things clear, this article refers only to rental income on the subject property you plan to buy.

A “Gotcha”: The FHA Self-Sufficiency Test

More is not always better when buying a multifamily home with FHA financing.

Recently, HUD started requiring the FHA self-sufficiency test for 3- and 4-unit properties. The rule doesn’t apply to duplexes.

The rule states that the property must bring in enough income to cover its full payment. Rates and prices are much higher than just a few years ago. It’s becoming increasingly difficult to get a property to pass the test.

You may want to keep things simple by looking for a duplex rather than a triplex or quadplex.

My Lender Says I Can’t Use Future Rental Income To Qualify

Your lender may say you can’t use future rental income to qualify for an FHA loan.

If this happens, shop around for a different lender.

This is an example of a “lender overlay,” or when a lender imposes additional rules on top of existing FHA guidelines.

Additional Considerations

Remember that owning a home is a significant financial responsibility. Becoming a landlord at the same time carries even more obligations.

Sure, you have to fix things when they break, which requires some financial reserves.

But a landlord has to deal with tenants and potential headaches if tenants don’t hold up their end of the deal.

What if your tenant can’t pay rent due to a job loss? Do you let it slide? At what point do you re-establish rules? These situations will come up, guaranteed. And because your tenant shares a wall with you, they can be even thornier.

The upside is building lasting wealth in your real estate investment. As long as you go into it with realistic expectations, protect your interests with lease agreements, and treat it like a business, becoming a landlord can pay off.

FHA Rental Income Guidelines FAQs

Do I need landlord experience to count future rental income for FHA?

No. FHA guidelines state that you can count future rents toward income even without landlord experience. If your lender tells you otherwise, they are imposing additional rules on top of FHA guidelines, called overlays.

Can I qualify for a multifamily FHA loan with no employment income?

No. The rental income alone will not be enough to qualify you for the property. Employment income will be the majority of qualification income; rental income is only a supplement.

Is buying a multifamily home with FHA financing “house hacking”?

Yes. Buying a multifamily home and living in one unit and renting out the others is known as “house hacking.” The strategy is to live in the property for 12 months (the minimum requirement), then convert the entire property into a rental. Using an FHA loan gets you into a rental property with a small down payment.

How to Apply

Applying for an FHA multifamily loan is just like applying for any other home purchase.

When you apply for an FHA loan, your lender will verify your income, employment, assets, liabilities, and credit score and history.The lender will work up a maximum home price and issue you a preapproval letter you can use to shop for homes.

Once you find a home and get your offer accepted, the lender will work with you to close the home purchase.