Mortgage shoppers are dumbfounded.

The day after Donald Trump won his second bid for the White House, mortgage rates skyrocketed past 7% according to Mortgage News Daily.

But on the campaign trail, Trump promised to bring down mortgage rates.

On September 12, 2024, Donald Trump stated at an Arizona rally that he would drive down rates to 2% during his upcoming presidency.

“We will drive down the rates so you will be able to pay 2% again,” Trump said to cheers, “and we will be able to finance or refinance your homes drastically at much lower costs.”

Is this simply campaign rhetoric, or is there any chance of this happening over the next four years? Let’s take a look.

Low Mortgage Rates Require A Terrible Economy. Markets Predict The Opposite Under Trump

Markets perceive Trump's policies as pro-business, yielding a stronger economy and a rising stock market. But those same elements are bad for mortgage rates.

It’s incredibly difficult to have both a rip-roaring economy and ultra-low mortgage rates. The two economic factors typically run in opposite directions.

Two eras in which the U.S. experienced mortgage rates in the 2-4% range were also very tough economically. First, the housing bust of 2008 led to the deepest recession since the Great Depression. But one positive was that the 30-year mortgage rate averaged just 4.18% from 2009 to 2019, says Freddie Mac.

Next, COVID brought worldwide shutdowns and epic job losses. Again, rates averaged 3.04% from 2020 to 2021.

It’s a bit of a mystery how Trump would lower rates to 2% without taking the economy down with them.

It’s More Likely Rates Will Remain Elevated

As much as homebuyers and current homeowners would like to see 2% rates, it’s more likely rates will remain elevated under Trump. At least, this is what markets are predicting.

There are a few reasons for this projection as discussed in greater detail here.

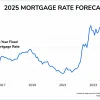

Rates were high last time: As shown in the above chart, mortgage rates rose for two years after Trump’s 2016 election win. They eventually hit 8-year highs before dropping.

Pro-business: Trump plans to cut corporate taxes and deregulate industries, creating a stronger business environment (remember: strong economy = higher rates)

Inflationary plans: Trump has floated placing tariffs on foreign goods, driving up costs. Another campaign promise, deporting undocumented residents, would remove workers from the economy. This would create a tighter job market, forcing companies to spend more on workers and driving up inflation. Inflation is bad for rates.

Trump would have to promise basically the opposite of many proposed policies to deliver low mortgage rates.

Can The President Control Mortgage Rates?

The president can’t directly control mortgage rates because they are determined by the free market.

Mortgage bonds, which determine mortgage rates, must offer high enough rates to be worthwhile for investors.

It’s a little like the president saying “Microsoft stock should be 50% higher.” Investors won’t purchase Microsoft stock at that price. It has to be worth that much, or they will lose money.

What About The Fed?

But what about the Federal Reserve? Can the president force lower rates through this government agency? The Fed is an independent body, not obligated to obey the president or any faction of government. One of its mandates is to keep inflation in check. Lowering the federal funds rate to 0%, for instance, might drop mortgage rates, but it could also spark uncontrollable inflation in an already-hot economy.

This is something the Fed won’t risk.

Would 2% Rates Even Be a Good Thing?

Ultra-low rates sound fantastic, but rates this low could cause problems, too.

First, it would likely mean high unemployment. Most people would rather have a job than a 2% mortgage they can’t afford.

Second, home prices would skyrocket. It’s still tight housing market in most areas of the country. Meanwhile, the largest generation in U.S. history, millennials, are coming into prime homebuying age.

Rates at 2% would plummet housing supply to all-time lows – perhaps lower than during the COVID era, pushing home prices to stratospheric levels.

National Association of Realtors Chief Economist Lawrence Yun told FOX Business that the economy needs about one million additional for-sale homes to balance the market. And that’s with rates near 7%.

Unless Trump also has plans to build a lot of homes quickly, 2% mortgage rates could be disastrous for the housing market.

What Should Mortgage Shoppers Do Now?

Mortgage rates could remain high. But waiting to purchase a home until the perfect time rarely pays off. Those who are comfortable with a mortgage payment and plan to stay put for at least five years should seriously consider buying.

Homeowners looking to refinance may have to be patient for their chance to lower their payment.

There is no perfect advice for every situation but to accept current conditions as they are and move forward.